Intestacy Rules

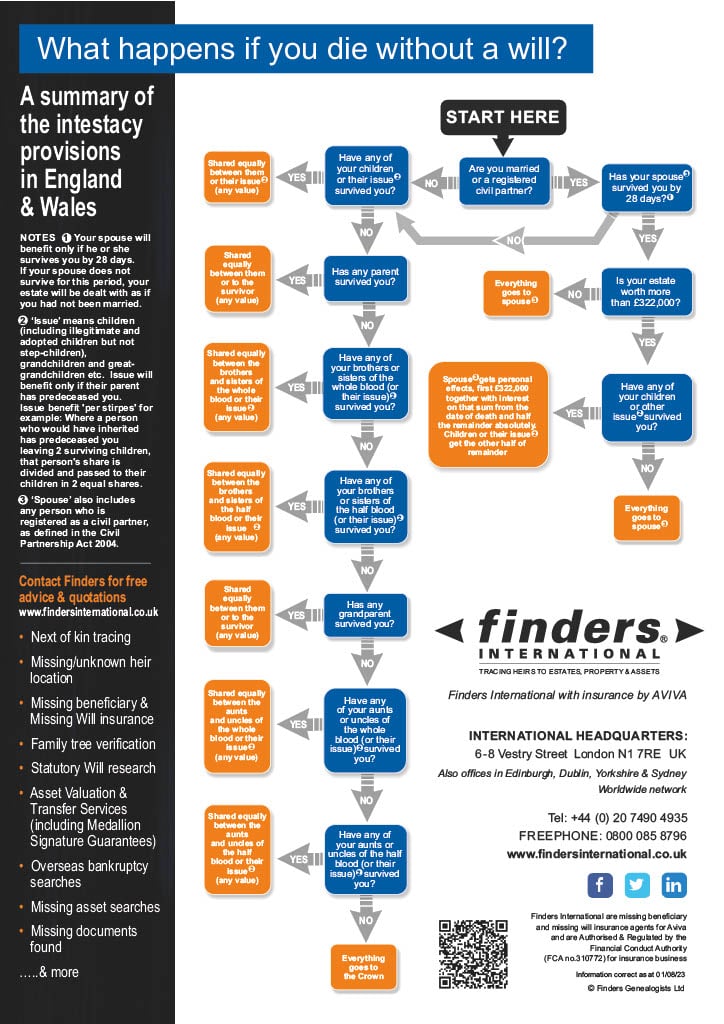

Intestacy Rules in England & Wales - what happens when a person dies intestate

Intestacy rules determine how an individual's estate (property, assets, and belongings) will be distributed if they pass away without having a valid will in place. The rules differ between countries within the United Kingdom, such as England and Wales, and Scotland.

What are the Intestacy Rules?

In England & Wales, when a person dies without a valid will, their estate is subject to the intestacy rules, which determine how their assets are distributed. Intestacy laws provide a framework for the fair and legal distribution of the deceased’s property and assets among their surviving relatives. This article aims to explore the English and Welsh intestacy rules of law, outlining the key principles, the order of priority of next of kin, and the implications of intestacy on the estate administration process.

Intestacy rules serve as a default mechanism for distributing a deceased person’s estate when no valid will exists. The rules are primarily governed by the Administration of Estates Act 1925, which has been amended over the years. These rules are designed to ensure a fair and logical distribution of assets based on familial relationships.

What does intestate mean?

In short, a person who has died without having made a will.

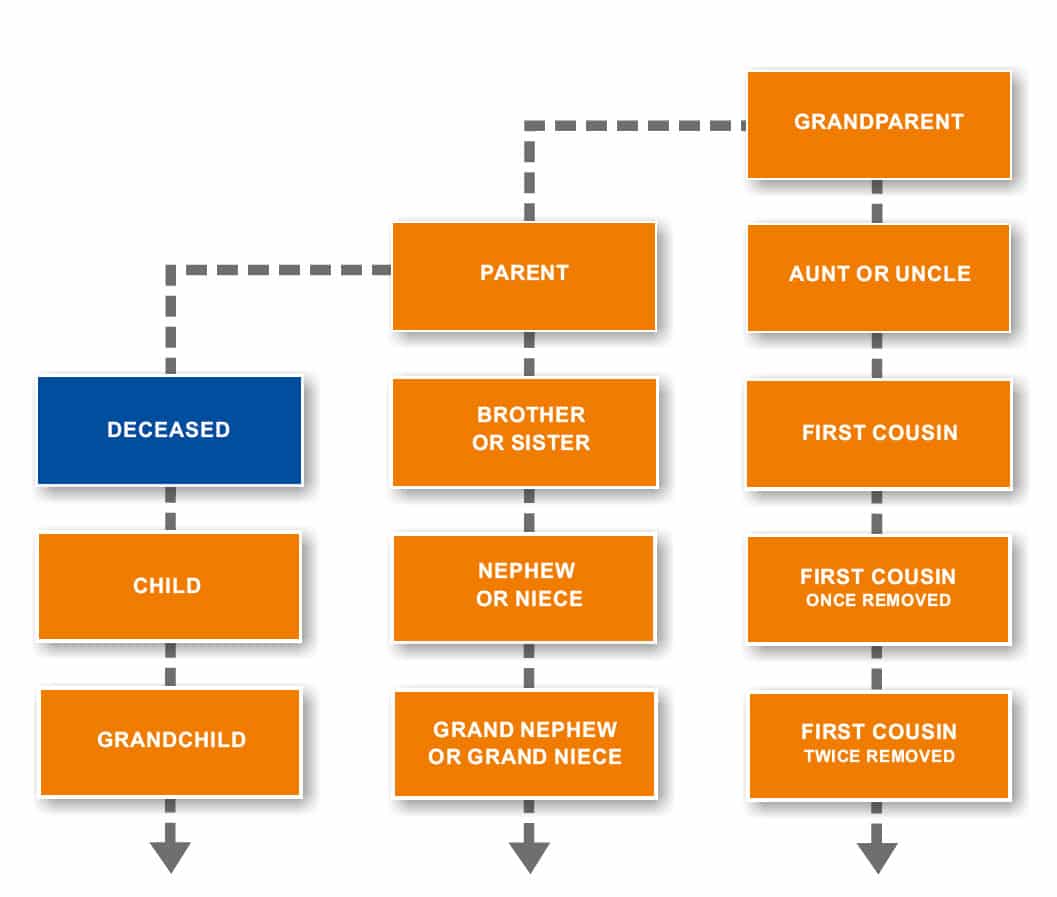

Next of kin – the Order of Priority according to the rules of intestacy

- In the absence of a surviving spouse or civil partner, the intestacy rules move to the next level of kin. If there are children, they will be entitled to the entire estate. If these children have also died, their surviving descendants will take their shares.

- If the deceased had no children but had surviving parents, the estate would be divided equally between the parents. If the parents have predeceased the deceased, the estate will pass to the deceased’s siblings or their children (or their children’s children and so on until surviving issue are found).

- If there are no surviving siblings or issue thereof, the estate passes to half-blood siblings or issue thereof.

- If there are no half-blood siblings, the intestate estate will be distributed among the deceased’s grandparents.

Can Cousins inherit under an intestacy?

Naturally, by the time the deceased has died, their grandparents will often all be deceased, so intestacy rules move on to aunts and uncles of the whole blood or their surviving issue, and so on, following a set order of priority that reflects the closeness of familial relationships.

This then includes cousins to the Deceased, but it is important to note that the intestate succession stops at the first surviving relative at each stage, but allows the descendants of next of kin of an equal to inherit their share:

If there are no surviving uncles and aunts of the whole-blood or surviving descendants, intestate succession in England & Wales allows for one final category of next of kin to inherit – half-blood uncles and aunts or surviving descendants thereof.

Here are some examples under Intestacy Rules

Q: The Deceased left 2 siblings, one is alive and one is deceased leaving 3 children; who inherits?

A: The Deceased’s sibling who is alive inherits half the intestate estate. The other half is due to the sibling who is deceased and therefore passes in equal shares to their children – one third of one half (or one-sixth of the total estate) to each of the 3 children.

Q: The Deceased left no spouse, issue or siblings of the whole or half-blood. There is one living aunt and 2 living uncles who have also died. One uncle left a surviving son (a 1st cousin to the Deceased). The other uncle left 2 children, one is alive and one is deceased, but left 3 children of their own who are alive. Who inherits?

A: The Deceased’s aunt and uncles receive one third of the estate each. The aunt is alive so she inherits her one-third share. The uncle who is deceased and left one son (a 1st cousin to the deceased) receives a one-third share which is directly passed to his only son. The final third is due to the other deceased uncle. His child who is alive receives half of this one-third share (one sixth of the total estate) and the one-sixth due to his deceased child is split between their 3 surviving children (one one-eighteenth share each of the total estate).

Need help tracing beneficiaries in England & Wales? Finders International are specialists in tracing next-of-kin to unclaimed estates. For further information on our probate research services, please contact us via our contact page, email: [email protected] or telephone: +44 (0) 20 7490 4935.

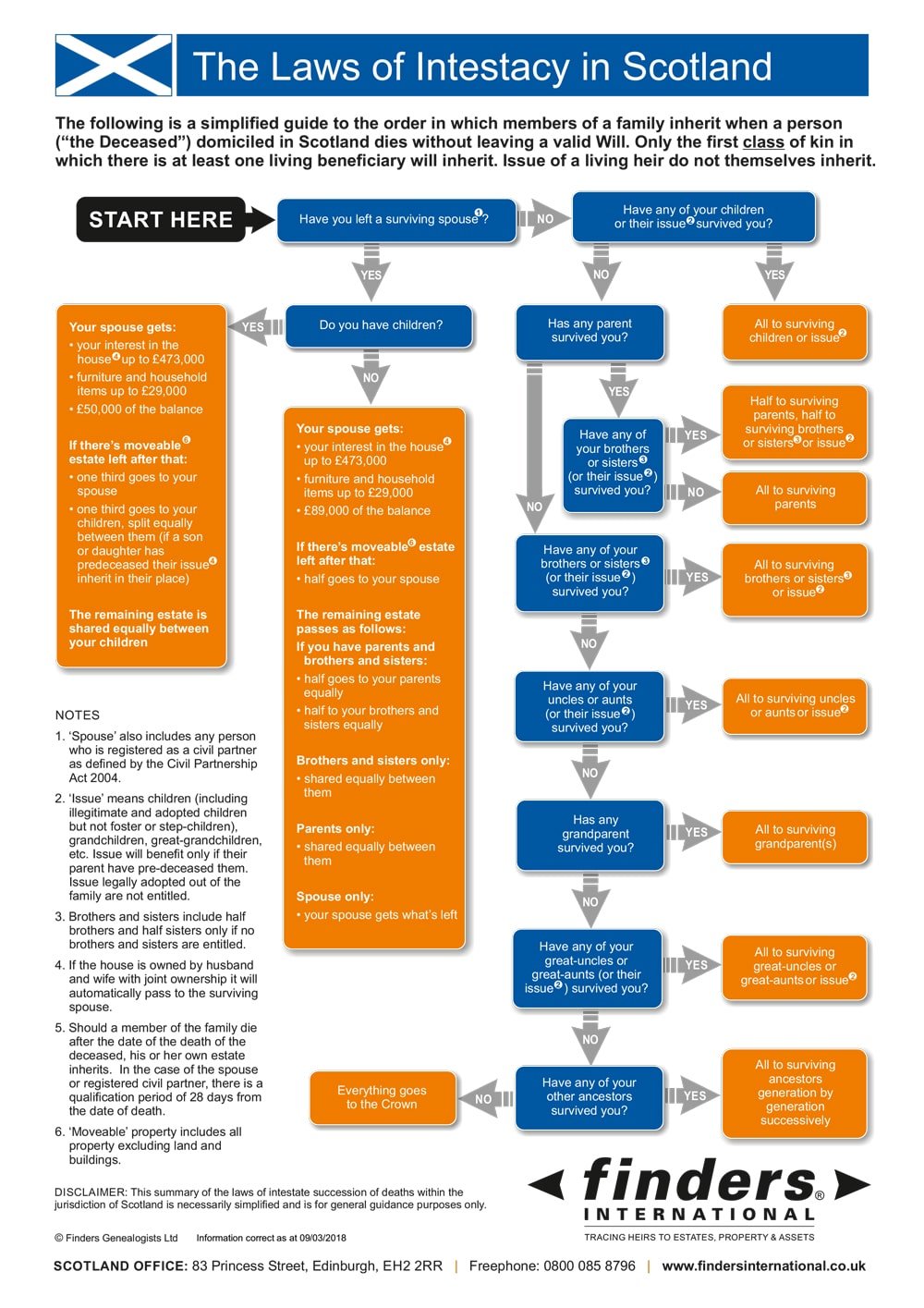

What are the Intestacy Rules for Scotland?

When an individual dies without leaving a will in Scotland, the distribution of their estate is determined by the intestacy law in Scotland. The intestacy rules in Scotland are set out in the Succession (Scotland) Act 1964.

These rules prioritise certain relatives, known as “heirs,” based on their proximity of blood relationship to the deceased. Intestacy rules can be complex and can vary depending on the circumstances of the deceased person’s death.

Next of kin – the Order of Priority according to the rules of intestacy in Scotland

- If the deceased is survived by a spouse or civil partner, they will inherit the whole estate, although children, parents and siblings may also inherit depending on the sums involved.

- If no spouse or civil partner exists but the Deceased is survived by children (or their issue*), they will inherit the whole estate.

- If the deceased has no spouse or children, the order of succession is as follows: Parents, siblings (or their issue*), aunts and uncles (or their issue*), great aunts and uncles and so on. Only the nearest class of kin with at least one living beneficiary will inherit.

Need help tracing beneficiaries in Scotland? Finders International are specialists in tracing next-of-kin to unclaimed estates. For further information on our probate research services, please contact us via our contact page, email: [email protected] or telephone: +44 (0) 131 278 0552.

Implications of Intestacy

When someone dies intestate, the distribution of their estate can become complex and may not align with the Deceased’s wishes. Without a valid will, there is no provision for specific bequests, charitable donations, or the appointment of executors.

Moreover, the intestacy rules do not account for non-traditional family structures, step-children, unmarried partners, or close friends who may have been financially dependent on the deceased. Without a will, these individuals may receive nothing from the estate.

DNA evidence and Court challenges can succeed in obtaining financial settlements for people whose relationships to the deceased were not documented in the traditional fashion.

Understanding the English & Welsh Intestacy and Scottish Intestacy rules is essential for anyone concerned about the distribution of their assets after death without leaving a valid will.

Intestacy can lead to unintended consequences, delays, and disputes, especially in cases where complex family structures or dependents are involved, but sometimes human nature (and sometimes superstition) defies logic and “intestate” remains the default legal status for most people.

NB: It’s important to note that intestacy rules are subject to change due to legal updates and amendments. To ensure accurate information, it’s recommended to consult legal professionals or authoritative sources specific to the current year.